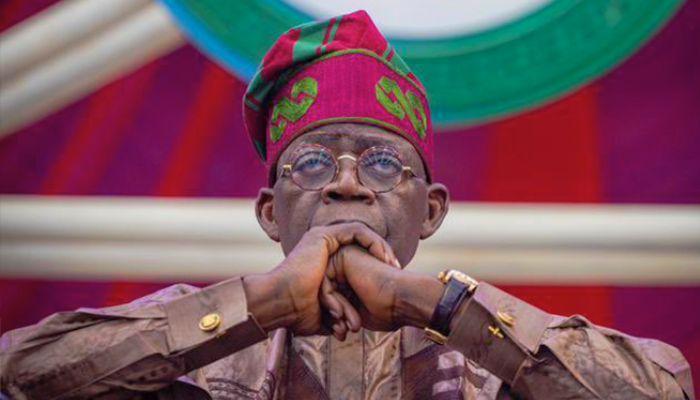

Nigeria’s gross domestic product rose to 4.33 per cent in the second quarter of 2025 from 3.13 per cent in the first quarter, with mixed feelings for Nigerians, investors and financial experts under the President Bola Ahmed Tinubu administration.

Nigeria’s economy grew in the period under review, according to the latest GDP data released by the National Bureau of Statistics on Monday.

The growth was pushed by non-oil sectors, which recorded 95.5 per cent compared to the oil sector, which stood at 4.05 per cent, according to NBS data.

A breakdown of NBS data showed that the service sector posted the highest at 56.53 per cent, followed by the agriculture sector with 26.17 per cent, then industries (17.31 per cent).

The oil sector also recorded remarkable growth at 4.05 per cent, up from 3.97 per cent in Q1 2025.

Despite the gains and excitement among the ruling All Progressives Congress Congress and Tinubu’s men, the data overstated Africa’s most populous nation’s economic woes.

This is because a further analysis of the Q2 2025 GDP growth showed that critical sectors like agriculture, manufacturing, trade, ICT, motor assembling, and others were relatively sluggish.

The impact is because of intensifying following the country’s high inflation and interest rates at 20.12 per cent and 27.50 per cent in August 2025.

The above statistics paint a gory picture for the majority of Nigerians battling the high cost of living.

Speaking to Bellnews on the development, the Director of the Centre for the Promotion of Private Enterprise, Muda Yusuf, the Chief Executive Officer of SD & D Capital Management, Gbolade Idakolo, and a don at Lead City University in Ibadan, Prof. Godwin Oyedokun, said despite the modest gains recorded, the Nigerian government needs to do more to see the figures impact on Nigerians and investors.

“This is quite remarkable, showing that quite a number of the government policies are on course. Particularly striking is the improvement of the oil sector. Posted a growth of 20.46 per cent in Q2 as against 1.87 per cent in Q1.

“This is evidence that some of the measures in the oil and gas sector have begun to yield results.

“Although we need to worry that some critical sectors of the economy are still sluggish in their recovery and growth. The agriculture sector, for instance, grew by 2.2 per cent in Q2 2025, although it is an improvement from 0.07 per cent in the previous period.

“Given the critical nature of the agriculture sector, I believe the government needs to do a lot more. The manufacturing sector is also sluggish.

“In fact, it slowed in Q2. The growth was 1.60 per cent against 1.65 per cent in Q1, which is a slight deceleration in growth. It is generally ok. The textile sector has been in a recession for quite some time, which is a concern. It is commendable that the air transport sector has recovered from recession.

“It posted a GDP growth of 6.34 per cent. Another critical sector that is slow is the trade, ICT, and motor vehicle assembly contracted in Q2; that is something to worry about. There is still a lot of work to be done.

“The economy is still largely dominated by the non-oil sectors. What we need to do more is to have more productivity in the non-oil sector so that beyond the contribution to GDP, we will see a contribution to revenue and jobs to the economy,” Yusuf told Bellnews.

On his part, Idakolo, while lauding the GDP growth, said the prices of petroleum products have not recorded significant reductions despite improved refining capacity in Nigeria, and interest rates and inflation have remained high for Nigerians.

“The GDP/economic expansion by 4.33% for Q2 3025, with the non-oil sector taking centre stage by contributing 95% of overall GDP, is expected.

“The non-oil sector, largely driven by agriculture, real estate, energy (electricity and gas) and finance, has contributed significantly to the economy in the past eight quarters, outpacing the oil sector due to deliberate economic policies of the government.

“The aggressive agricultural policies of the government have seen lowering food prices and price stability in goods and services. There is also a strong performance from the oil sector, with oil production rising to 1.68 mbpd.

“However, prices of petroleum products have not recorded significant reductions despite improved refining capacity in Nigeria.

“The interest rates are also still very high despite improved performance from the finance sector, comprising the banking and insurance sectors.

“Overall, the economic expansion is a positive development and also shows the present government’s capacity to eventually turn around the economy,” he disclosed to Bellnews.

Also, a don at Lead City University in Ibadan, Prof. Godwin Oyedokun, did not mince words in commending the policies of the government which have contributed to the rise in Q2 2025.

He, however, noted that quality of growth, structural weaknesses, unbalanced growth Debt and fiscal pressures are major spoilers of the quarter’s GDP growth.

“Non-oil dominance: With 95 percent contribution from non-oil activities, sectors such as agriculture, manufacturing, ICT, trade, and financial services are proving to be the real engines of growth. This reduces vulnerability to global oil price shocks.

“Economic resilience and sustained expansion above both Q1’s 3.48 per cent and the government’s projection (3.76–3.89 per cent) show reforms are improving productivity and investor confidence. Job creation potential, Growth led by non-oil sectors, especially agriculture and services, suggests more opportunities for employment and SMEs and Positive fiscal signals:Diversified growth broadens the tax base and strengthens fiscal sustainability over time.

“Quality of growth: Headline GDP expansion does not yet reflect in the cost of living; high inflation and exchange rate volatility continue to erode household welfare.

“Structural weaknesses and infrastructure deficits (power, roads, logistics) still constrain production and competitiveness, limiting how far non-oil growth can go.

“Unbalanced growth: While services are booming, sectors like manufacturing remain under pressure from high energy costs and import dependence.

“Debt and fiscal pressures: Despite stronger revenue potential, high debt service obligations (69 per cent in 2024) still limit fiscal space for capital projects that would sustain growth momentum.

“This is a positive milestone. The fact that the non-oil sector is now the main driver of Nigeria’s GDP signals a realignment towards a more resilient, diversified economy.

“However, the gains must be consolidated by addressing inflation, stabilising the naira, and scaling up infrastructure investments. Without these, growth risks being ‘jobless or non-inclusive’, leaving households still under pressure despite upbeat macro figures,” he stated.