The Central Bank of Nigeria (CBN) ordered the printing of 500 million pieces of new naira notes in the first contract, which rolled out last week, December 15, 2022.

Aisha Ahmad, deputy governor in charge of financial system stability, disclosed this during House of Representatives hearing on implementation of CBN cash-less policy and the new withdrawal limits.

She noted that there are 31 Deposit Money Banks (DMBs) with 4,603 branches as at October 2022. In the Other Financial Institutions (OFIs) sector, there are 878 Microfinance Banks (MFBs) with1,966 branches; Agents- 1.4million; PoS Terminal- 899,642; and Number of ATMs is over 14,000.

What this means is that if 4,603 branches of banks divide 500 million, it will mean that each bank branch received 108,624.81 pieces of new naira.

Bellnewsonline.com reported from its findings that commercial banks are rationing the new naira notes they have received from the CBN as many customers are keen to hold the redesigned notes.

Nigeria had 122.3 million active bank customers in 2021, according to Statista, provider of market and consumer data.

According to Ahmad, a review of the cost of currency management from 2017 to 2021 indicated an average increase of over N10 billion per annum and over 90 percent of currency management costs are attributed to banknote production.

This, she said, affects the CBN and other participants in Nigeria’s currency management sector (banknote production, storage processing, distribution activities and banknote destruction).

In recent times, she said currency management in Nigeria has faced a series of challenges that have affected the ability of the CBN to efficiently carry out its mandate of issuing legal tender (i.e. provision of an adequate volume of clean banknotes in the right denominational mix for members of the public).

“The challenges have continued to grow in scale, with the attendant consequences on the Bank’s policy effectiveness, if left unaddressed,” she said.

Some of the challenges include wholesale hoarding of naira banknotes by members of the public, worsening shortage of fit banknotes in circulation, high and increasing cost borne by the bank, high risk of counterfeiting, and non-compliance with international best practice in currency redesign.

The deputy governor said the current series of naira banknotes have been in circulation for between 14 – 21 years, which is inconsistent with global best practice and exposes the notes to the risk of counterfeiting. Standard practice is that currency in circulation should be redesigned or re-issued after every 5 – 8 years.

Despite the dominance of highly advanced payment systems, many countries carried out currency redesign to remain ahead of counterfeiters, ensure durability, fight corruption, and reduce cost of currency management, among other reasons.

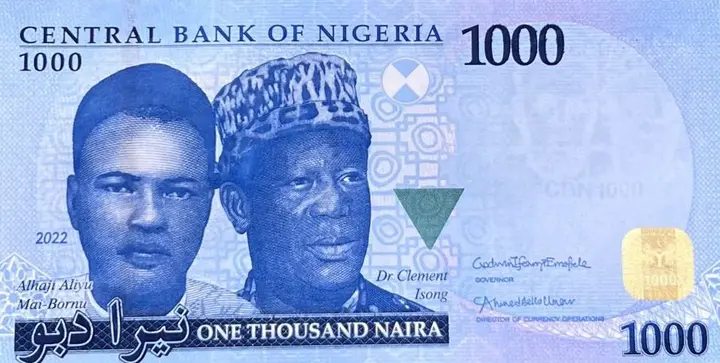

“It is against the backdrop of the foregoing that the CBN in line with its statutory powers as enshrined in Section 2(b) and 19 of the CBN Act 2007, sought and obtained the approval of Mr. President to redesign and issue new series of Naira notes in the N200, N500 and N1000 denominations,” Ahmad told House or Representatives.

The CBN has revised the cash withdrawal limits in response to mounting pressure by the public.

Consequently, individuals can now withdraw not more than N500,000 instead of N100,000 weekly, while corporate organizations can withdraw a maximum of N5 million as against N500,000 per week.

This was disclosed in a letter to all banks signed by Haruna Mustafa, CBN’s director of banking supervision, and released on Wednesday. According to the letter, in compelling circumstances where cash withdrawal above the stated limits is required for legitimate purposes, such requests shall be subject to a processing fee of 3 percent and 5 percent for individuals and corporate organizations, respectively.